👋 Hi friends -

Welcome to The Newsletter Growth Memo. Twice a month, I share short reflections with my newsletter clients + other operators.

Zero formality, ads, or affiliate links - just a guy sharing learnings from working with media operators doing $25-500k+ / month with newsletters.

New reader highlights: Welcome to Jeremy, VP of partnerships @Coindesk | Sid, COO @Blockworks | Caroline, Director of Social Media @ThePointsGuy, Caitlin, Director of Growth @Gear Patrol | George, VP of Growth @The Information

Quick note: I’ll be attending the AMO conference in NYC today - if you’re in town, come say hi!

For newsletters that monetize via sponsorships:

Whose responsibility is it to drive ad click-through rate… your sales team or your marketing team?

Many newsletters I speak with don’t have an immediate answer.

They may not even monitor their overall ad CTR at all beyond reports sent to advertisers.

That could be an issue.

You can’t evaluate what isn’t tracked and you can’t fix what isn’t owned.

Imagine this scenario:

Your marketing team gets excited they’re lowering your CPL

It turns out CPL is trending lower because you’re driving readers unqualified to purchase from your sponsors

Your overall CTR looks fine, but under the hood, ad CTR is declining

Three months go by and sponsors begin to complain

Everyone realizes ad CTR has been declining, but its too late for Q1 renewals

The first thing everyone should do is track.

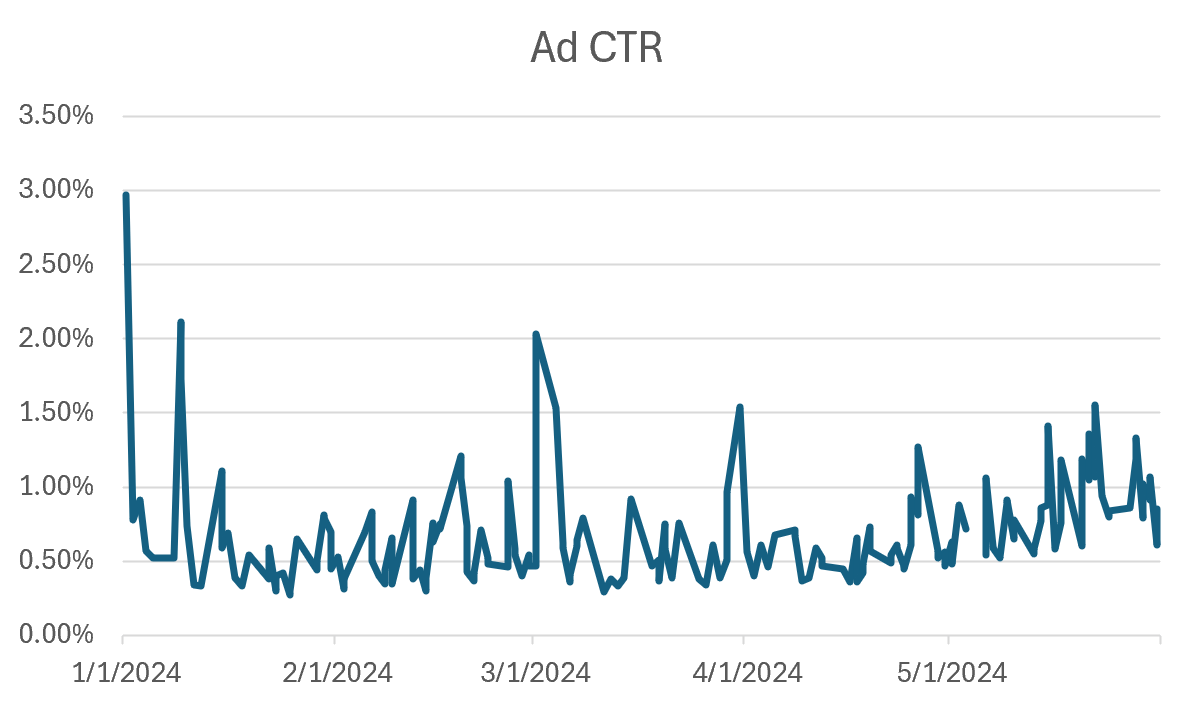

Here’s the ad CTR from a major newsletter we work with for the first 6 months of 2024.

Sales + marketing should have weekly meetings that begin with a chart like this one.

Now, who owns ad CTR - marketing or sales?

I think the answer depends on your timeline.

Short-term fluctuations in ad CTR aren’t usually impacted by marketing, which may only be growing the list by 5-10% per month vs. a giant base of readers.

Short-term ad CTR is driven by:

Sponsor-audience fit

Copywriting

How often you’re showing your audience sponsors they’ve already seen before

The sales team owns these.

Long-term trends in ad CTR are closely tied to:

Who the marketing team is adding to the list

How much you’re investing in audience growth to maintain the performance of your highest-frequency sponsors

The owner here is marketing.

Today’s topic - what do you do if your ad CTR begins to decline?

A newsletter we’re working with is starting to see a decline in ad CTRs.

I’ll walk you through our view of why it’s happening, the data we use to get there, and how I think we solve it.

We’ve looked at several metrics that (IMO) balance insight with practicality for operators who don’t have $500k+ to build out an analytics team.

There are 4 things we’re looking at.

Cohorted open rates

Cohorted CTRs

New vs. returning sponsorship ad CTR

Average sponsorships by month

Let’s dig in.

Open rate, cohorted by subscriber age

I want to validate if older cohorts of readers are opening the newsletter as much as younger cohorts.

To be clear - you should expect that open rate will decline over time.

But, if you see a huge drop between 2 neighbor cohorts it’s a signal your editorial team made a shift in content strategy readers don’t like.

Thankfully, we’ve got great engagement among cohorts.

I don’t believe we have a content issue.

Interested in how we compile / analyze this data? Shoot me a reply and I’ll send you a loom on how you can turn raw sponsor data into useful insights.

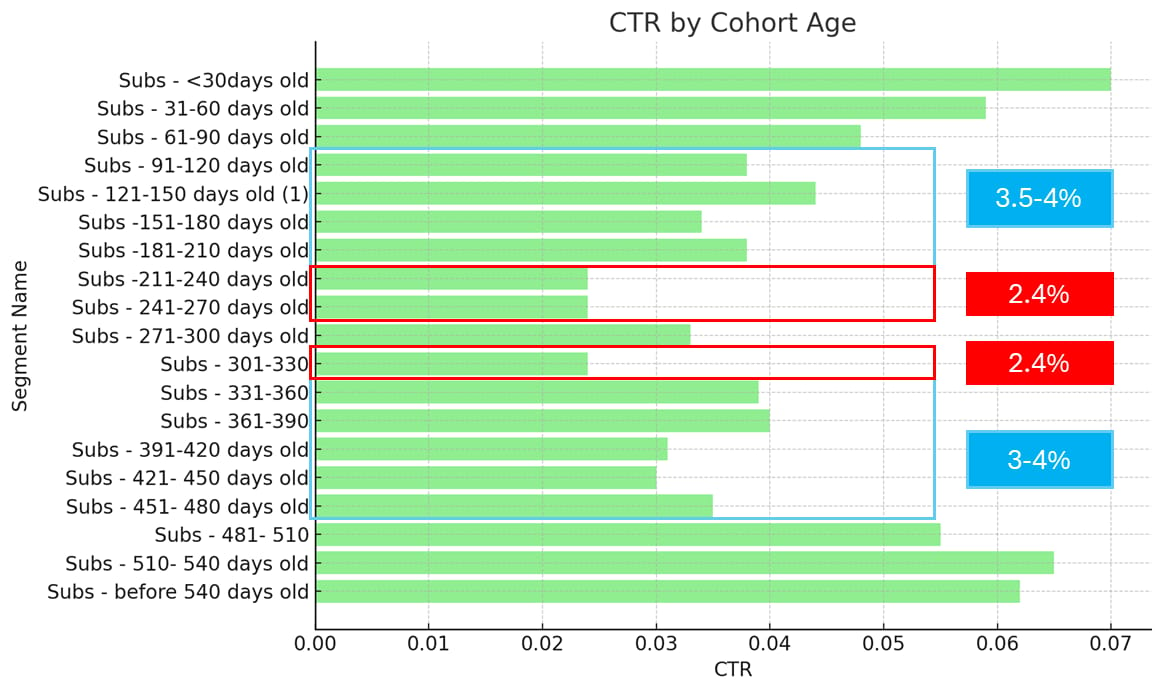

CTR, cohorted by subscriber age

The click-through rate is another story.

Take a look at this:

This newsletter has CTRs that begin around 7% and slowly plateau at 3-4% as subscribers age.

Except for 3 cohorts with 50% lower CTR than their neighbors.

It turns out, these cohorts came from a particular channel our client had invested in and one we now caution operators about using.

That was insight #1 - we have a partial diagnosis.

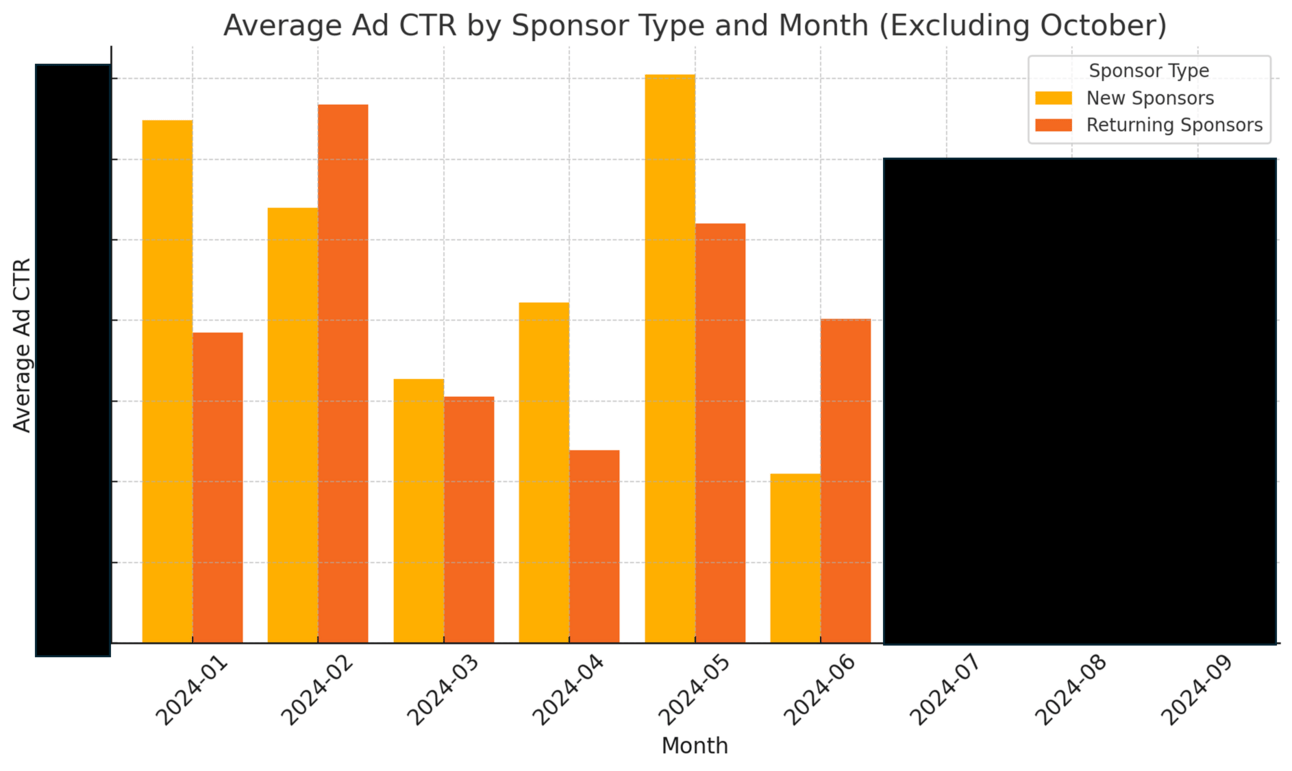

New vs returning sponsor CTR

Your returning sponsor ad CTR will decline in performance over time unless you’re sufficiently growing your list.

Returning sponsor ad CTR was 30-80% lower than new sponsor ad CTR in 4 of the past 6 months.

This trend continued into Q3.

This is a sign we need to invest heavily into growing the list or have the sales team diversify into new partners.

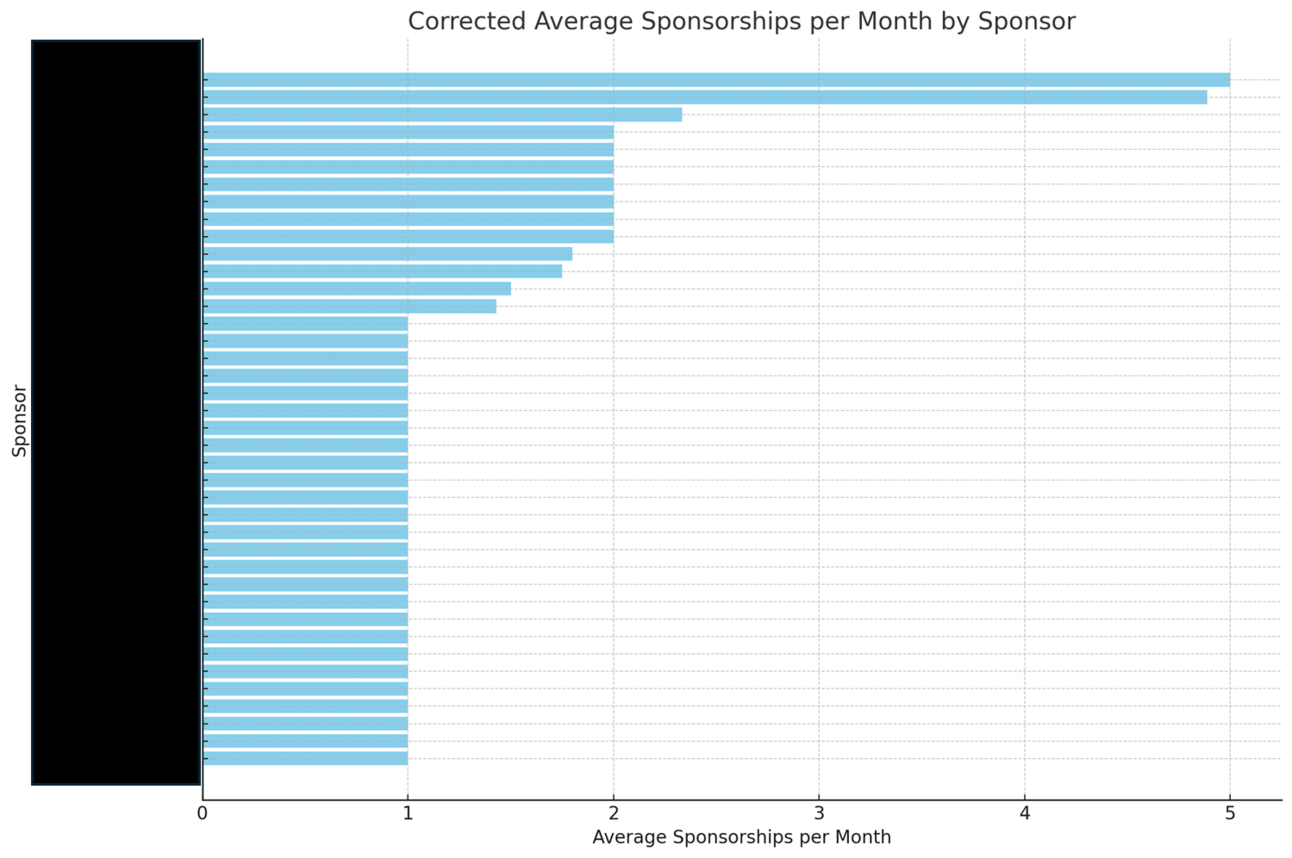

Average sponsorship slots per month

Long-term sponsors are the dream, but place them too much and your audience might get tired.

Some of the teams I meet with regularly like 1440 and Arnold Schwarzenegger’s Pump Club have very long-term partners.

These teams try not to place a single sponsor more than 3x per month to avoid saturation.

This, in addition to investing in list growth, helps maintain sponsor performance indefinitely.

In this newsletter, you can see two partners at the 5x per month mark.

So what do we make of all of this? I have two hypotheses:

Invest in list growth so that the abnormally low CTR channel is a lower % of the overall audience mix

Push sponsorship outbound to drive new logos, starting with newsletter readers (Wouter built an enrichment tool we’ll use to strategically target B2B decision-makers)

The question we’re figuring out now -

What the ad CTR for Meta readers is vs. other channels and how many readers do we need to acquire to meaningfully improve ad CTR.

Why cut all this data?

I think it’s really important to focus on solving the right problem before solving the problem right.

Getting into data like this is the best thing you can do to make sure your sponsorship and marketing teams are choosing the right problems to solve.

We’ll keep you updated.

That’s the letter.

- Nathan May

Interested in how we compile / analyze this data? Shoot me a reply and I’ll send you a loom on how you can turn raw sponsor data into useful insights.

Find me on LinkedIn

Have a question on growth/monetization? Reply here, on LinkedIn, or shoot a note to [email protected]

This is a private newsletter - if you want a teammate added, please reach out with their email